When Is An Irrevocable Trust Not Really Irrevocable?

As discussed in a previous blog post, trusts are widely misunderstood as a tool for the uber-wealthy, when in fact they are an integral part of most estate plans, from the simplest to the most complex.

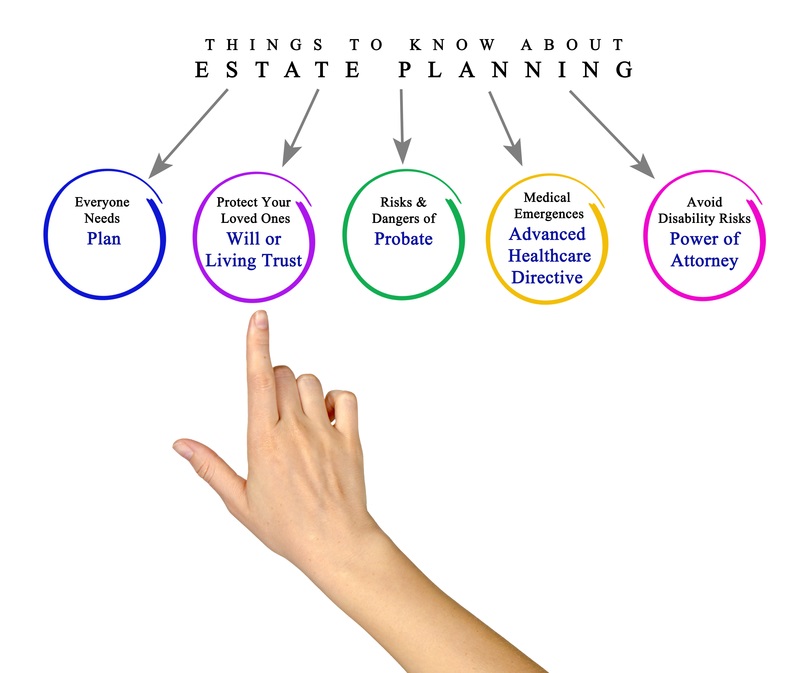

To review, any trust has three players: a Settlor, a Trustee and a Beneficiary. The Settlor creates (or “settles”) the trust and the Trustee manages the trust assets based on written instructions from the Settlor (typically in the form of a Trust Agreement) for the benefit of a Beneficiary. A trust can be created during the Settlor’s lifetime (a “Living Trust”), in which case the trust can be either revocable or irrevocable; or upon the Settlor’s death, usually under the provisions of a Will (a “Testamentary Trust”) which, because the Settlor is deceased, is always irrevocable.

An Irrevocable Trust cannot be revoked or modified in any way, exactly as the name implies. While it is beyond the scope of this post, the irrevocable nature of a trust can result in tax implications when the Settlor transfers property to the trust.

But are Irrevocable Trusts truly irrevocable? Not necessarily. Courts in New Jersey have historically entertained applications to terminate or modify Irrevocable Trusts, but the implementation of the Uniform Trust Code in New Jersey last summer has brought a much greater degree of certainty to this area of the law.

The Trust Code provides that either the Trustee or a Beneficiary of an Irrevocable Trust may bring an action in court to modify or terminate the trust. Why might a court grant such a request? One reason might be the existence of circumstances that were not anticipated by the Settlor when the trust was created. For example, perhaps the Settlor established a trust for a disabled beneficiary who is no longer disabled. Modification or termination of the trust in that circumstance might be appropriate, particularly where the provisions of the trust are intentionally restrictive in order to preserve governmental benefits commonly received by disabled individuals.

An Irrevocable Trust can also be terminated upon consent of the Trustee and all Beneficiaries, if the modification or termination is not inconsistent with a material purpose of the trust. Whether the modification or termination is inconsistent with a material purpose of the trust may be open to debate, but the crucial point is that if all parties involved (the Trustee and Beneficiaries) consent, then an otherwise Irrevocable Trust can be modified or terminated without involving the court.

The relative ease in which Irrevocable Trusts can be terminated or modified may be somewhat disconcerting to Settlors of those trusts. But remember, a termination or modification by consent must not be inconsistent with a material purpose of the trust, and the Trust Code further directs courts to consider the “probable intent” of the Settlor in determining whether termination or modification is appropriate. Therefore, settlors concerned with ensuring that their intentions for creating an Irrevocable Trust are followed should strongly consider including a detailed statement of purposes in the Trust Agreement.

If you have any questions about this post or any other matters, please contact me at jjcostellojr@nmmlaw.com.